Ways to Give

Giving from Your 401k or IRA Retirement Plan

Leave family the balance of savings and checking accounts, and donate double-taxed assets like IRAs to us.

You've worked hard and planned for retirement. Now, with a little creativity, you can leverage your retirement assets to benefit you and your family, reduce federal taxes, and support St. Stephen's and St. Agnes far into the future.

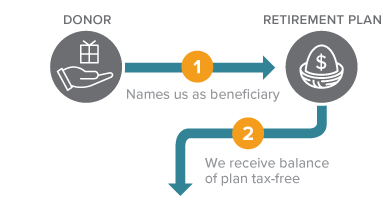

How It Works

- Name or designate St. Stephen's and St. Agnes School as a beneficiary of your IRA, 401(k), or other qualified retirement plan.

- Pass the balance of your retirement assets to St. Stephen's and St. Agnes by contacting your plan administrator.

- Important! Tell St. Stephen's and St. Agnes about your gift. Your plan administrator is not obligated to notify us, so if you don't tell us, we may not know.

70 ½ or older? Make a “Tax-Free” Gift Through Your IRA

- Qualified Charitable Distribution (IRA Rollover)

Note: SECURE Act 2.0 increased the Required Minimum Distribution (RMD) age from 72 to 73, and it will increase again to 75 beginning in 2033 (for individuals born in 1960 or later). The age for making a Qualified Charitable Distribution (QCD), however, remains 70½. This allows charitable-minded individuals to make tax-free donations from their IRA before they are required to take taxable RMDs.

Benefits

- Continue to take regular lifetime withdrawals.

- Maintain flexibility to change beneficiaries if your family's needs change during your lifetime.

- Your heirs avoid the potential double taxation on the assets left in your retirement account.

Next

- Frequently asked questions on retirement plans.

- Contact us so we can assist you through every step.